The Bajaj Group has been one of India’s leading industrial enterprises for over 9 decades now. Its presence can be felt across various sectors such as automobiles, finance among others thereby making it a key player in the Indian economy. Amongst the many businesses that fall under this vast conglomerate; Bajaj Finserv holds immense value and potential for investors who are looking to grow their wealth within this insider’s guide we shall take an in depth look into what makes up bajaj group shares but mainly focusing on Bajaj Finserv Share Price and giving some useful tips as well as information which may prove helpful for them

Understanding The Bajaj Group: A History Of Excellence

Established by Jamnalal in 1926 ,The Bajaj Group is now a multi-sector enterprise with strong presence in wide-ranging industries. Innovation , quality products and customer satisfaction have always been at the heart of this group which sets standards for excellence and reliability.

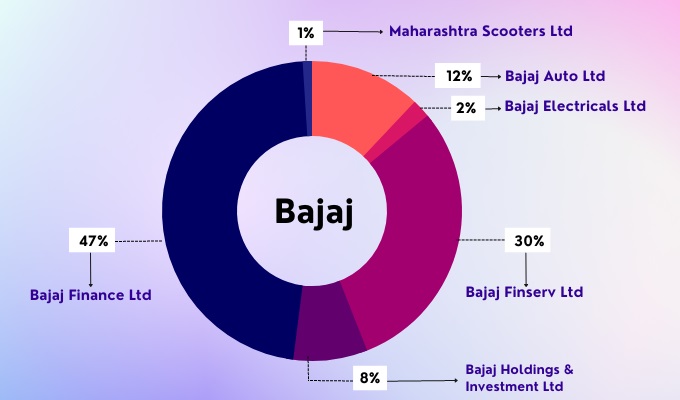

Overview of stocks owned by BAJAJ GROUP

Stocks under the umbrella of Bajaj group cover different segments like automobile (Bajaj Auto), finance (Bajaj Finserv) etcetera; these companies are publicly traded on stock exchanges around the world where they can be bought or sold depending on one’s preference . Investors keep close tabs on them due to their growth prospects as well performance indicators being used while trading shares.

Bajaj Finserv: A Financial Giant

Among other Bajaj groups’ investments into financial services industry, it stands out most given its magnitude both locally and internationally through insurance policies provision ;credit lines issuance ;wealth creation management strategies implementation etcetera .Its solid business model coupled with strong market position supported by strategic initiatives undertaken thus far have made many people consider investing here instead than any other equally good performing sector despite lower returns expected because risks involved are considered minimal compared to those faced.

Factors affecting Bajaj Finserv Share Price

There are several factors that affect the price of a share in any given company. For Bajaj Finserv, these factors include:

Financial Performance: Investors look into financial statements like revenue statement; profit margin analysis; return on equity ratio computation; debt situation assessment etcetera so as to know how well or bad off is this firm financially and also its chances of growing further still.

Market Sentiments : These refer to what people think about future expectations concerning an entity such as bajaj group stocks based on current trends seen across various markets especially economies indicators released periodically .Positive perception usually leads to increase demand thus pushing up prices

Competition among peers within same industry space could also greatly impact Bajaj Finserve’s stock performance since market share being fought over might be having some unique characteristics which if not properly addressed by management team would otherwise negatively affect investor confidence levels resulting into decline

Ways In Which You Can Invest In Bajaj Group Stocks

If you are interested in investing in stocks of the Bajaj Group, specifically Bajaj Finserv then consider these strategies;

Fundamental Analysis: Before making any investment decision it is important that one conducts thorough research on various aspects about the company i.e., its financials, business model, industry position and growth prospects among others.

Diversification: To minimise risks associated with single sector investments only put money into different sectors represented by bajaj groups’ shares hence spreading risk across economy

Long term investing: Taking long-term view can help achieve better results since over time bajaj groups have shown resilience even during economic downturns furthermore they always come out stronger than before

Keep an Eye On Market Trends: Stay informed through latest news updates regarding how things may pan out so far as performance of companies listed under bajaj is concerned due regulatory changes or revised economic outlook projections made known from time to time

Get Advice From Financial Advisors: It’s always wise seeking services qualified experts who specialize in Indian equities so as they offer personalized strategy development based on specific needs